Selling an affordable home

As the current owner of an affordable home, you hopefully recall that when you purchased your home you were able to purchase that home at below market value, under the requirement that in the future you would sell the home at a restricted price to a low or moderate income household. Each year, the CHLT sends out an annual notice to its homeowners to remind them of their obligations under the deed restriction or ground lease in place.

Overview of the Process

Step 1. Notify (in writing) the CHLT of your intent to resell your home. An email or traditional mail are both acceptable forms of communication for this notification. Please email mlodge@housingnetworkri.org or send your written correspondence to CHLT, 1070 Main Street, Suite 304, Pawtucket, RI 02860. The following information should be included in your communication:

- Complete property address

- The number of town recognized bedrooms in the unit

- Current monthly condo or homeowner association fees, if applicable

- Your contact information

Based on this information we will calculate the current maximum resale price of your home. There is a resale fee due from you as the seller of $500 to the CHLT, which we factor into the resale price. The fee will be collected at the closing as a seller charge, but effectively if you receive a full price offer on the home, you would be reimbursed this fee by the buyer at closing.

Step 2. Once you receive information about the maximum sales price and you decide you want to proceed with listing the unit, please have your realtor reach out to our office so that the resale process can be reviewed with them in greater detail.

Step 3. Potential buyers can be directed to the “Buying an Affordable Home” portion of this website to get an overview of eligibility criteria, or they can reach out to Melina Lodge at (401) 721-5680 ext. 104 or mlodge@housingnetworkri.org to discuss their specific circumstances.

How is the maximum sale price calculated?

As housing valuation is driven by market supply and demand, Rhode Island has seen a huge surge in pricing of market rate homes, making homeownership out of reach for many R.I. households. Affordable housing is developed using various types of public subsidy and as such, results in homes that are required to remain affordable for anywhere between 30 and 99 years. This long term restriction ensures that homeownership can remain within reach across generations of homebuyers in that a formulaic approach is used to calculate resale value, rather than market conditions. While affordable homes may see an increase in their value over time, that increase will be likely less than the increase in value of a comparable market rate unit. It is also possible under the resale formula, that there is no real increase in the property’s value, or on rare occasion, even a decrease in its value. As with market rate housing, there is no guarantee that appreciation will take place, and no way to reliably predict how much appreciation will occur.

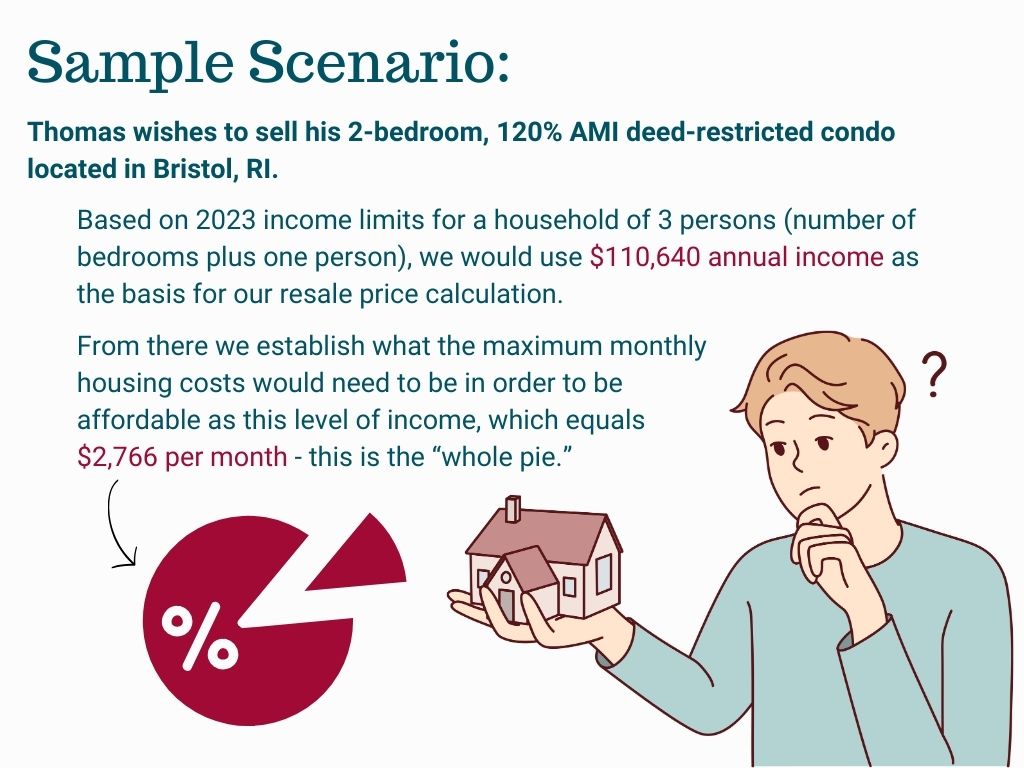

To help you understand how the resale formula affects pricing, here is an explanation of how the CHLT will calculate the resale price.

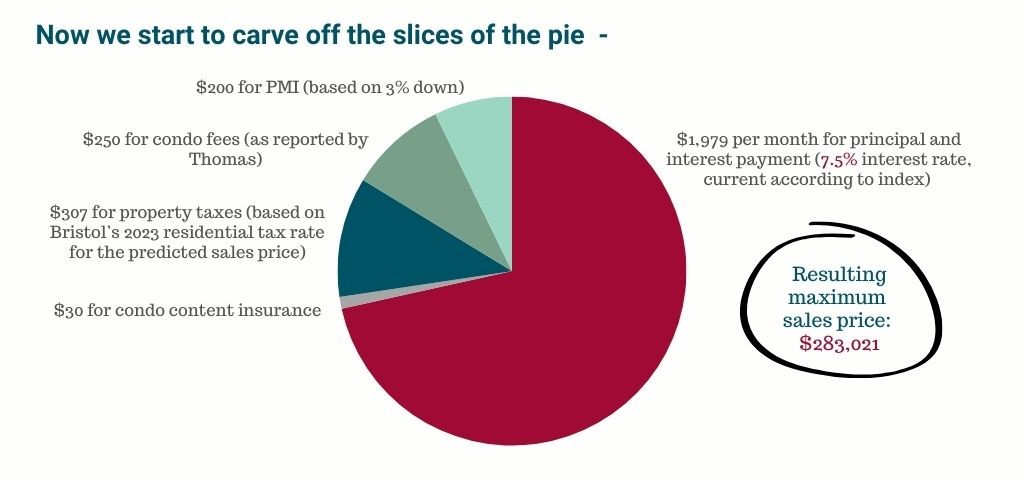

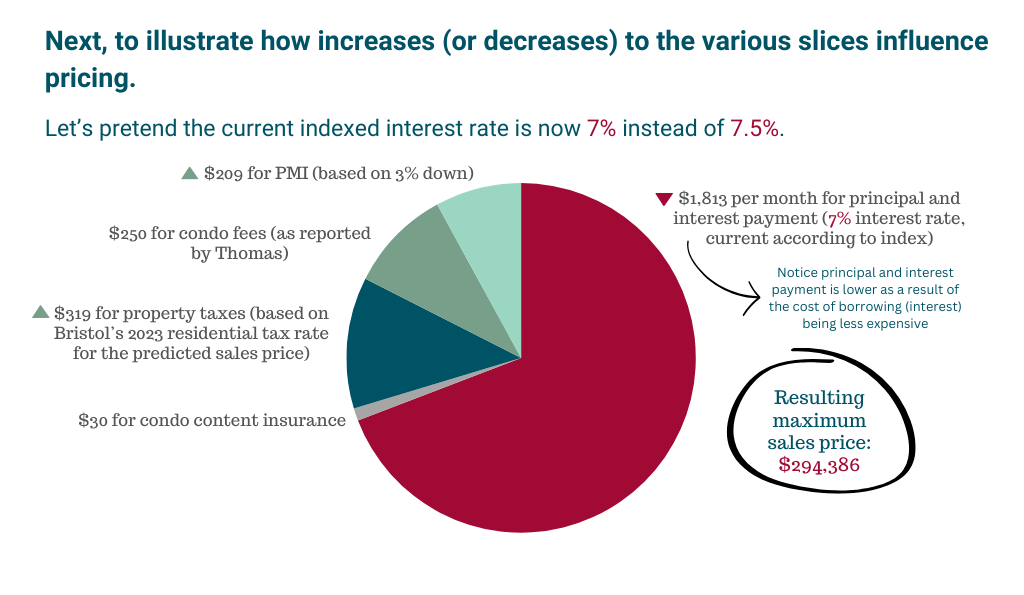

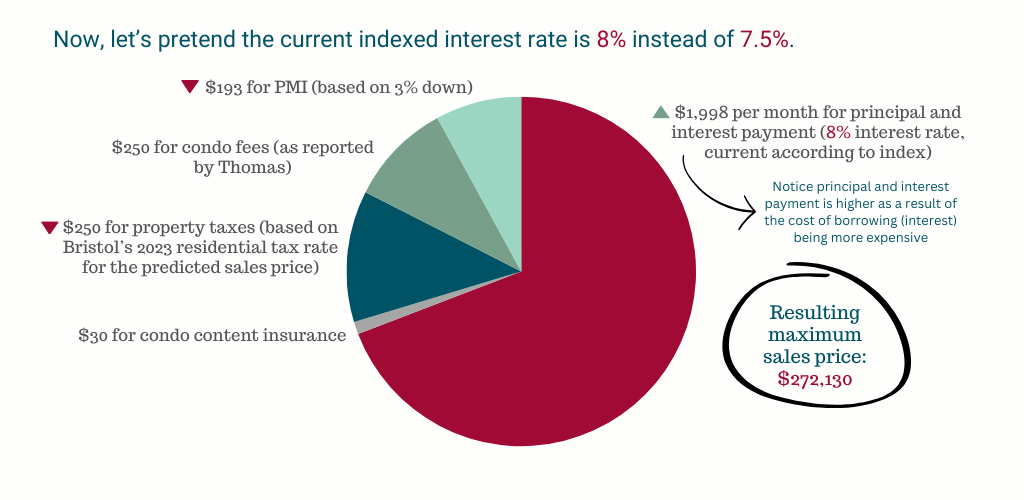

The basis for the calculation begins with referring to the income restrictions in place on the property, as spelt out in the Deed Restriction or Ground Lease. This will typically be one of the following – 120% AMI, 100% AMI, or 80% AMI. From there the CHLT will use [the number of bedrooms in the unit plus one person] to establish what income limit, in dollars, applies to the resale formula. Then, based on the definition of affordability (30% of gross income), a dollar amount is generated that will represent the maximum amount each month that a household could spend on their total housing costs for it to be affordable to them. One helpful way to think of this is to think of monthly maximum housing costs as representing a whole pie. The various fixed costs – property taxes; condo content or homeowners insurance; condo, HOA or ground lease fees (as applicable); PMI; interest payments – represent slices of that pie. After all of the other costs have been deducted from the whole, the only slice of pie that remains is the amount available to the homebuyer for principal reduction, and we are able to back into a maximum sales price. The slice of pie attributed to principal reduction is predetermined by the size of the other slices – so increases or decreases to those costs, relative to what those inputs were at the time you purchased the home, will directly influence the maximum sales price that you receive. For purposes of consistent calculation across time, we make generic assumptions using the same standards for the various cost components – property tax (use current municipal tax rate, based on sales price as valuation); PMI costs (assume 3% down); interest rates (based on current Freddie Mac index); condo content or homeowners insurance (based on market average); condo, HOA and ground lease fees (as reported by homeowner).